Before any discussion of workers’ compensation benefits can be meaningful, it is essential to understand the concept of the Average Weekly Wage (AWW). The AWW forms the basis for most benefits a worker will receive during the course of a workers’ compensation claim. Because the Average Weekly Wage directly affects how much compensation a worker is paid, workers are ill-advised to simply take their employer’s word on it.

In this post, we will examine the basic computation of the AWW and discuss several common questions that arise when trying to determine the correct AWW.

Basic Computation of the Average Weekly Wage

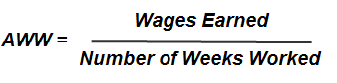

Section 10 of the Illinois Workers’ Compensation Act provides the basic rules for computing the Average Weekly Wage, using a two-part formula that looks like this:

The formula looks simple enough, but the challenging part is knowing what wages can be included, and what number of weeks should be used. The answers depend on several factors we discuss below.

Base Wages Earned

Salaried employee calculations are usually very easy. If you are paid by salary, then your weekly salary is typically your Average Weekly Wage.

For hourly employees, a simple rule to follow is to determine the wages earned is to start with the date you last worked, as shown on last paycheck you received before you were injured. From that check, go back for 52 weeks and add up all of your straight time wages. We’ll call this your “regular pay.” Don’t count any bonuses, overtime wages, or any other payments you received besides straight time wages at this point. You can’t include any other earnings besides your straight time wages unless you are allowed to add them as discussed in the sections below.

Additions to your Wages Earned

Overtime Earnings

Overtime is considered to be any hours worked in excess of your regular work week. The general rule is that you are not allowed to include wages from overtime in figuring the AWW. The exception to this rule is that you may include earnings from overtime work only if your overtime hours were mandatory or regularly worked. You should note that even if you do get to include overtime hours, you only get to count them at the straight time rate (not time and a half or double time).

Mandatory hours are easy to understand. If you are required to work overtime as a condition of your employment, you get to add the wages for those hours you worked in the year (at your straight time rate) to your regular pay.

Whether non-mandatory overtime is regularly worked is bit harder to understand. We can’t put an exact number on how many hours over how many weeks will be considered “regularly worked.” If your regular work week was 40 hours, and you worked overtime in something over half of weeks, then you probably will be able to add the wages for those overtime hours (at your straight time rate) to your regular pay. Whether you can include overtime in less half of the weeks is a question that needs to be answered on a case by case basis.

If your regular work week consisted of less than 40 hours, you have a more complex situation than can be answered here. You may be able to include your wages over your normal work as overtime, but it is not possible to say without having additional information.

Bonuses

You are not allowed to include bonuses in your AWW. However, just because your employer calls something a “bonus” does not necessarily mean it is a bonus for our purposes. Think of bonuses this way. If the money you received is like a gift and doesn’t have anything to do with how hard you worked, when you worked, or you taking on some undesirable task, then it is treated like a gift and you can’t include it. A common example would be a Christmas bonus. You received this as a gift, regardless of how hard you worked. It cannot be included.

Say you get a “production bonus” because you and your coworkers’ exceeded a quota or met some other goal. It is pay you received for work you performed. You get to count it in your wages, even though it is called a “bonus.” Another common example of bonus pay would be hourly shift differential bonuses for working the midnight shift. You get to count it. You also get to include all of the regular hourly pay you might get for working on Sunday or Holidays, as well as vacation days paid and sick days paid, as they are a part of compensation for you working, not gifts.

Wages from a Second Job

If you had a second (or additional) job that you worked on the date you were injured, you may be able to include the earnings from your additional jobs in computing your average weekly wage. This is known as “concurrent” employment.

The rules of concurrent employment are simple.

1. You had to have the job on the date you were injured. If you stopped the day before, or planned to start next week, you can not include it.

2. Your employer must know that you had concurrent employment before you were injured.

3. The concurrent employment is a typical type of job. That is, you worked for someone else and they paid you an hourly wage, salary, or sales commission. If the job you had was a self-employment job, you will not be allowed to include those wages unless you can demonstrate with a high degree of reliability that the job was a real job, and that the pay was made on a standard periodic basis (eg. Weekly). A nebulous claim of lost profits is not going to count.

4. You can provide paycheck stubs, employers earnings statement, tax withholdings, and/or estimated tax payments to actually document your earnings from the other job. A undocumented claim of concurrent employment will fail.

If you can meet all of the above 4 criteria, the wages from your concurrent employment can be added to your wages earned.

A word of warning may be in order here. If your injury does not disable you from your additional job, you may be prevented from recovering any Temporary Total Disability benefits. You may still be entitled to temporary partial disability benefits, but being able to work in your second job demonstrates that you are not totally disabled. On the brighter side, however, the addition to the average weekly wage from concurrent employment will hopefully make up for the loss when it comes time to conclude the claim for permanent disability.

Computing the Number of Weeks Worked

If you worked a full 52 week period before your injury, and you didn’t have any serious interruptions in your earnings (missed more than 5 days of uncompensated work during the year) your AWW calculation is pretty simple. Add up all the wages you are allowed to count and divide by 52. That will be your average weekly wage.

If you didn’t work a full 52 weeks, but you did work quite a few full work weeks, say 26 or more, that’s okay. Add up all the wages you are allowed to count then divide by the number of full weeks that you did work.

Regardless of the number of weeks that you worked, if you missed more than 5 days during the past 52 weeks that you didn’t get paid for, or your work week is not a full work week (5 days a week), or you didn’t work at least 26 full work weeks, the computation of the number of weeks worked can get a lot more complicated. You should consult with a lawyer, as it is impossible to give you any definite guidance without having a lot more information. Remember, the calculation of the Average Weekly Wage directly affects how much compensation you are entitled to. If you want to be treated fairly, you need to get it right.

Adjustments to the Average Weekly Wage

Once you have determined your Average Weekly Wage, you will then use it to compute the correct rate for payment of Temporary Total, Temporary Partial, or Permanent Total Disability benefits (66.666% of the AWW) and/or a Permanent Partial Disability rate (60% of the AWW). Once you have calculated the proper disability rate, you must then compare it to the rates tables published by the Workers’ Compensation Commission for minimum and maximum rates. Here are the current rate tables. Note that the date ranges shown are for the date of injury, not the current date. If the rate you calculated is above the maximum, your rate is capped at the maximum rate shown in the table. If the rate you calculated for a particular benefit is below the minimum listed you should use the minimum rate for that particular disability benefit, but only so long as your AWW is higher than the minimum rate. If the AWW is lower than the listed rate, you should use the AWW as your disability rate.

There are some special rules that apply, depending on the type of benefit being computed. For example, other minimum rates apply when an employee is permanently and totally disabled. And, where compensation is being paid for a decreased earning capacity claim, the AWW normally has nothing to do with the computation of benefits.

We hope that this information is helpful in understanding the concept of average weekly wage as it applies to your workers’ compensation claim. As always, if you have any questions or need assistance with a claim, give us a call. Hanagan & McGovern PC. www.hmcomplaw.com 618-241-9251